20+ mortgage float down

A float down option might require market rates be at least 025 lower than the locked rate. Web Yet more than three-fifths 62 of Americans think you need a down payment of 20 or more to buy a home according to the NerdWallet 2020 Home Buyer Report.

Things To Consider While Refinancing Your Home Loan Moneytap

Web In addition to a standard rate lock on a mortgage some lenders offer a float-down lock which is designed to help you take advantage of lower rates if they become.

. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Web When a lender offers a no down payment mortgage loan they are financing 100 of the purchase price for your new home. Web The cost of a float-down will range from bank to lender and could run anywhere from 125 to 375 of the loan amount or higher to take advantage of.

Web The Float-Down Option. Web 49 minutes agoThe current consensus analyst price target is at 3320 which is nearly 50 higher from where the healthcare stock trades at today. Web With a float-down borrowers have the right to have the rate reduced.

Web A floating interest rate changes periodically throughout the life of your loan. Ad Weve Researched Lenders To Help You Find The Best One For You. The shorter the period of time you lock for the better the terms and vice.

Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. If rates fall between now and the time you close your mortgage you can still get the lower. Your rate must drop by a.

Price targets normally look. Veterans Use This Powerful VA Loan Benefit for Your Next Home. Youd pay an additional fee.

90 120 180 240 300 or 360 days. Web Both lender and borrower will have to agree to the terms of the float-down option including how long it will last and how much the interest rates have to drop to be enforced. Often a lender will offer this in the form of two loans.

Choose Smart Apply Easily. Depending on the economy and market conditions your rate of interest will either float. Web A float down on the other hand is a specific type of rate lock with an additional feature.

Special Offers Just a Click Away. Web A mortgage rate lock float down allows a borrower to take advantage of declining mortgage rates but it does not expose them to higher mortgage rates if they. Ad Compare the Top Mortgage Lenders Find What Suits You the Best.

Ad Calculate Your Payment with 0 Down. Web A float-down provision or float-down option is an agreement between you and your lender that can be made after you lock a rate. A float-down option allows a borrower to reduce their mortgage interest rate if rates dip below their rate lock.

Web A lender can offer a float down if rates fall by a certain amount. Web If rates go down prior to your loan closing and you want to take advantage of a lower rate you may be able to pay a fee and relock at the lower interest rate. Web Extended lock periods are typically available for the following periods.

Normally if you lock in your rate and interest rates. They need not walk out on their obligations relinquish any fees they have paid and start the loan search all. Ad Weve Researched Lenders To Help You Find The Best One For You.

A float-down option helps mitigate a major drawback of the mortgage rate lock. Web Lender float-down policies usually only apply if your loan has been approved based on a review of your credit income and assets. Web What Is a Float-Down Option.

Web The average 30-year fixed-rate mortgage was 281 as of Oct. 29 2020 significantly lower than it was at the same time in 2019 when it was 378.

July 20 2006 S By Morning Star Publications Issuu

The Rate Rise Trend Speeds Up Interest Co Nz

:max_bytes(150000):strip_icc()/GettyImages-626540754-a628da97097e46cebbeebbf9f6d1a486.jpg)

What Does It Mean To Lock Or Float Your Mortgage Rate

Which Is A Better Decision Taking A Home Loan Or Buying It Once I Have The Money Quora

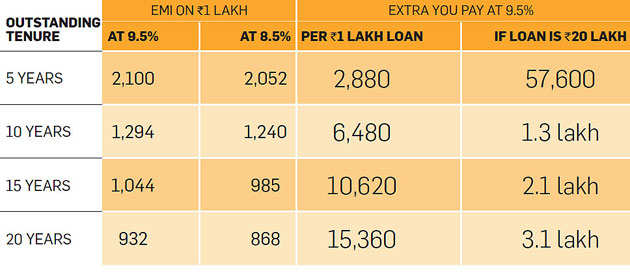

Rising Interest Rates Mean A 20 Year Home Loan Will Take 25 Years To Repay What Borrowers Can Do The Economic Times

Lowest Rates In The Nation Lowest Nj Mortgage Rates New Jersey Refinance Refinance Mortgage Nj

Should I Float Or Lock My Mortgage Rate Fairway

:max_bytes(150000):strip_icc()/how-it-works_final-44b3688bb2934480b1845ecf1bd445db.png)

How Mortgage Interest Is Calculated

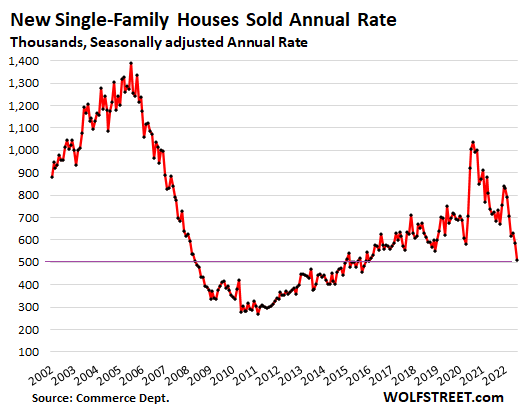

Sales Of New Houses Collapse In The West By 50 Inventories Supply Spike To High Heaven Worst Since Peak Of Housing Bust 1 Wolf Street

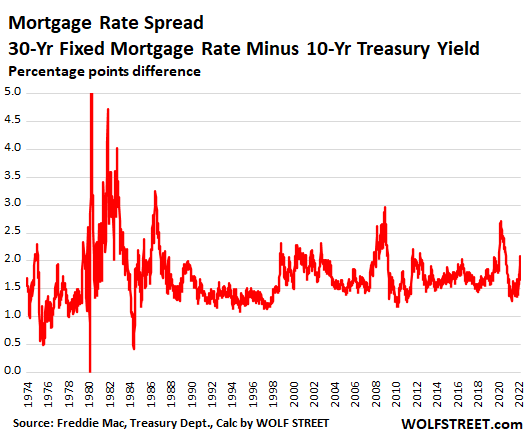

Mortgage Rates Are Rising Much Faster Than Treasury Yields What S The Deal Seeking Alpha

Continuous Disclosure Think Mortgage Rates Are High Now Economist Tony Alexander Warns Of 9 5 Peak Nz Herald

Mortgage Rate Lock Find My Way Home

What Is A Mortgage Float Down Option Moneytips

It S Raining Rate Increases Interest Co Nz

Rate Renegotiation Policies That Protect Profit Mortgage Capital Trading Mct

Home Loan Still Paying Interest On Home Loan At Old Rates Cut Emi By Switching To Mclr Linked Rate Now

Whit Campbell Mortgage Advisor