36+ Should i borrow the maximum mortgage

Our Maximum Mortgage loan rental income calculator will help you to find out the maximum mortgage you can borrow based on your currently propertys real or valuated rental income. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

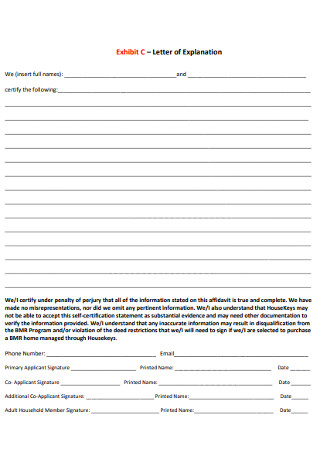

36 Sample Letter Of Explanation Templates In Pdf Ms Word

How much income do you need to qualify for a 450 000 mortgage.

. If youre looking to borrow at much lower levels but want to maximise what you are eligible for a good rule of thumb is that the majority of providers use an income multiplier. Ad See Todays Rate Get The Best Rate In A 90 Day Period. That largely depends on income and current monthly debt payments.

Explore Quotes from Top Lenders All in One Place. Looking For A Mortgage. Ad Get the Right Housing Loan for Your Needs.

You need to make 138431 a year to afford a 450k mortgage. Compare Offers Side by Side with LendingTree. Under this particular formula a person that is earning.

Its A Match Made In Heaven. When you apply for a mortgage loan your lender will use your income and outgoings to calculate the maximum amount you can borrow. These are your monthly income usually salary and your.

Take Advantage Of 2022 Mortgage Rates When You Buy Your Next Home. For home prices 1. See How Much You Can Save.

Call 314 361-9979 - Its the top question potential buyers ask before starting to shop for a new home. For example if you earn 30000 a year you may be able to borrow anywhere between 120000. Ad Compare Mortgage Options Calculate Payments.

Lenders will typically use an income multiple of 4-45 times salary per person. Ad Compare Best Mortgage Lenders 2022. Were Americas 1 Online Lender.

To be able to borrow a 200k mortgage youll require an income of 61525 per year. Review 2022s Top 10 Mortgage Rates Lenders. This maximum mortgage calculator collects these important variables.

Try Our Maximum Mortgage Prime A Calculator This is your total principal interest taxes heat and 50 of your condo fee PITH. Some experts expect buyers to be able to borrow 15 per cent more although this change is likely to be gradual. Home Loan - How Much Can You Borrow.

Although a lender may offer you the maximum loan for. Before you invest 200k into a home youll. Begin Your Loan Search Right Here.

Compare Lowest Home Loan Lender Rates Today in 2022. The maximum amount you can borrow with. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online.

Or 4 times your joint income if youre applying for a mortgage with. Buying a home at the top of your budget could compromise other financial goals. It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan.

There are two main factors that are taken into consideration to determine how much of a mortgage payment you can handle. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. The mortgage should be fully paid off by the end of the full mortgage term.

Most future homeowners can afford to mortgage a property even if it costs between 2 and 25 times the gross of their income. Apply Online Get Pre-Approved Today. Note both loans aim for a 36 DTI which is typical for a conventional.

How much can I borrow. Get Preapproved You May Save On Your Rate. We base the income you need on a 450k.

Comparisons Trusted by Over 45000000. How much you can borrow for a mortgage in the UK is generally between 3 and 45 times your income. When the bank considers how much you can afford it looks at your current.

Apply Now With Quicken Loans. What is your maximum mortgage loan amount. The Best Companies All In 1 Place.

Ad Mortgage Rates Have Been on the Decline. Ad Top-Rated Mortgage Lenders 2022. If the home purchase price is between 500000 and 99999999 you must have at least 5 for the first 500000 and 10 for the remaining amount.

The banks will want to be seen as prudent Johnston said. The percentage of your homes value that can be borrowed on a refinance loan known as the maximum loan-to-value ratio varies by loan program and occupancy type but generally the. Generally speaking most prospective homeowners can afford to finance a property whose mortgage is between two and two-and-a-half times their annual gross income.

Maximum monthly payment is calculated by taking the.

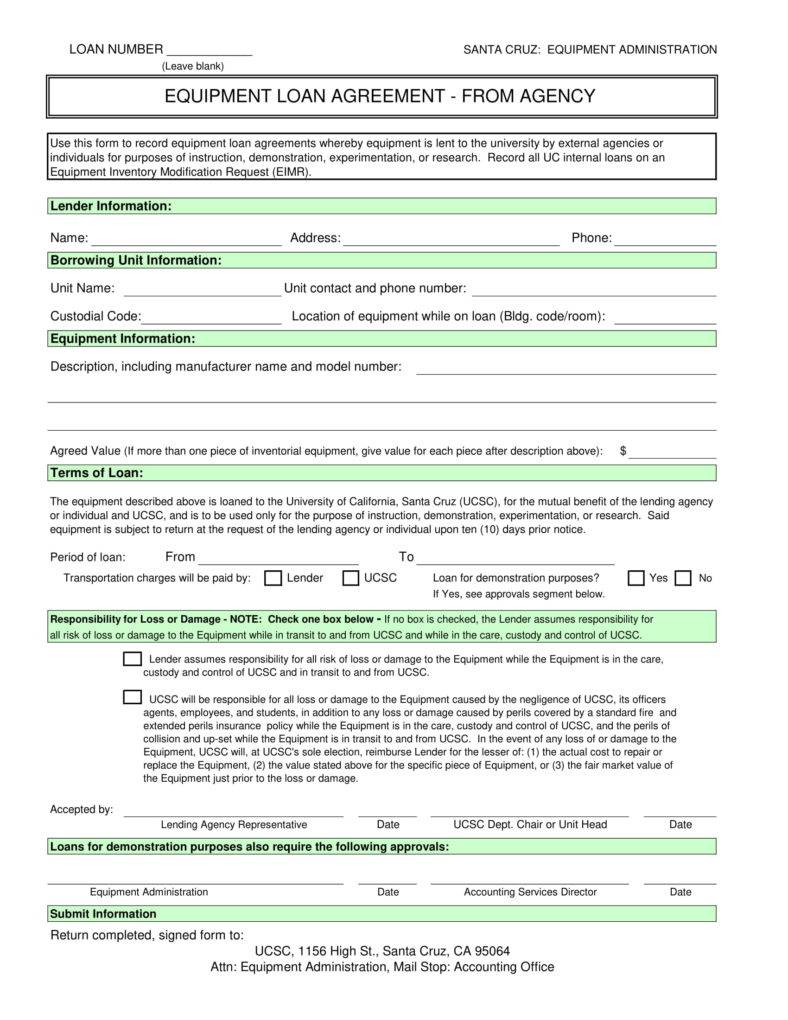

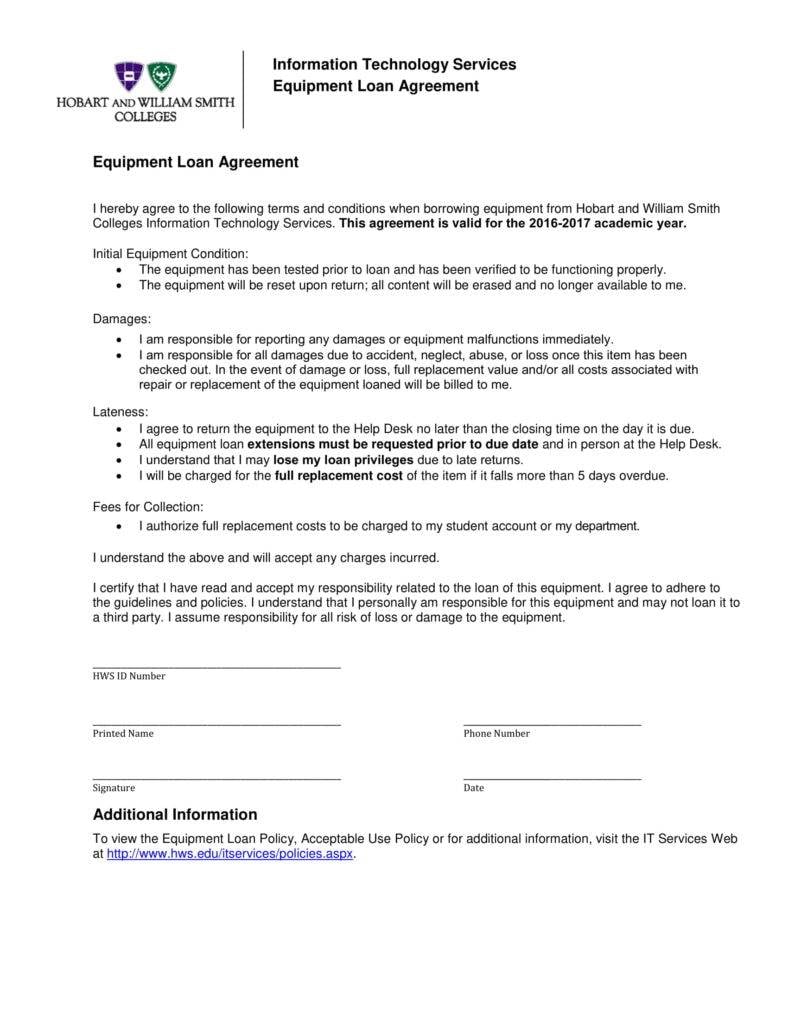

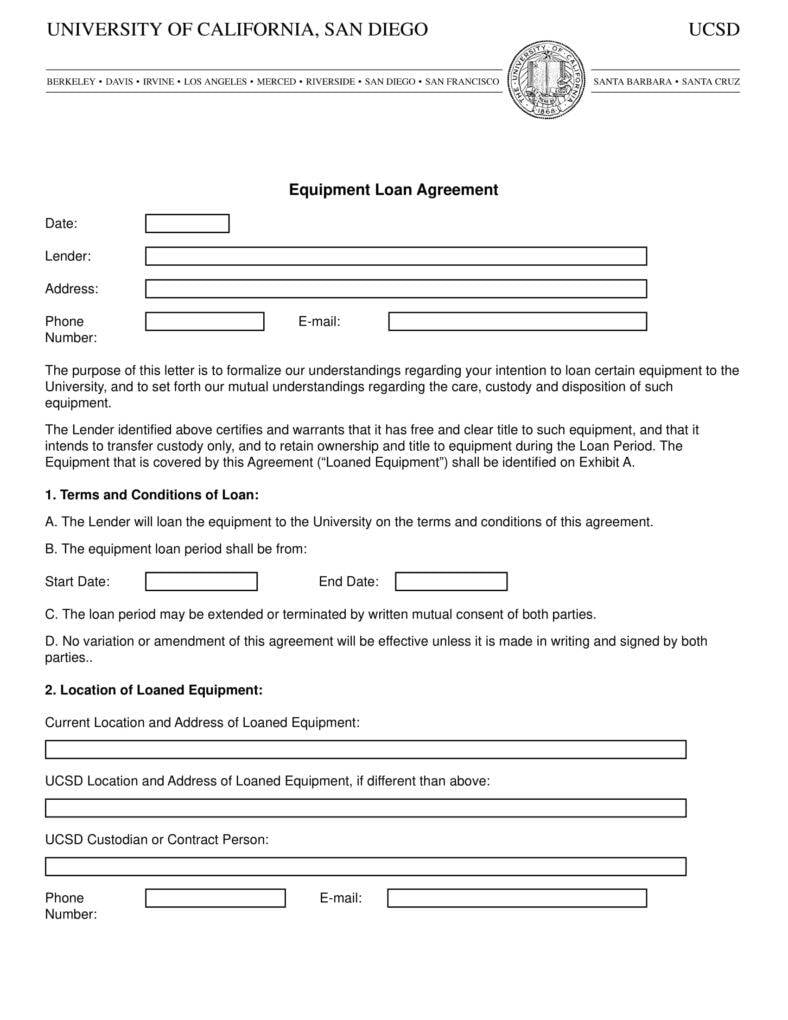

6 Equipment Loan Agreement Templates Pdf Word Free Premium Templates

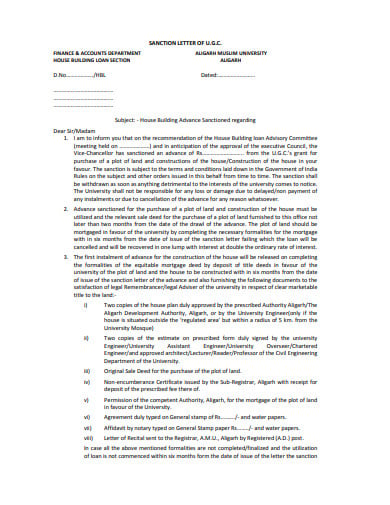

3 Loan Sanction Letter Templates In Google Docs Word Pages Pdf Free Premium Templates

Use Our Mortgagecalculator To Help You Set Your Budget Price Your Payments See How Making Additional Paym Home Buying Tips Mortgage Calculator Calculators

3 Loan Sanction Letter Templates In Google Docs Word Pages Pdf Free Premium Templates

Free 5 Small Business Loan Proposal Samples In Ms Word Google Docs Apple Pages Pdf

Free 5 Small Business Loan Proposal Samples In Ms Word Google Docs Apple Pages Pdf

2

Pros And Cons Of Fha 203k Loan Free Business Card Design Fha 203k Loan Business Card Design

36 Sample Letter Of Explanation Templates In Pdf Ms Word

6 Equipment Loan Agreement Templates Pdf Word Free Premium Templates

3 Loan Sanction Letter Templates In Google Docs Word Pages Pdf Free Premium Templates

6 Equipment Loan Agreement Templates Pdf Word Free Premium Templates

6 Equipment Loan Agreement Templates Pdf Word Free Premium Templates

Free 5 Small Business Loan Proposal Samples In Ms Word Google Docs Apple Pages Pdf

3 Loan Sanction Letter Templates In Google Docs Word Pages Pdf Free Premium Templates

36 Sample Letter Of Explanation Templates In Pdf Ms Word

Fha Closing Cost Assistance For 2022 Fha Lenders In 2022 Fha Closing Costs Real Estate Tips